The Managing Director of HFC Bank (Ghana) Limited, Anthony Jordan, has disclosed that the bank attempted buying collapsed UT and Capital Banks to save them from folding up.

GCB Bank Limited last year took over the two banks. This was after the Bank of Ghana (BoG) “approved the Purchase and Assumption transaction with GCB Bank Ltd that transfers all deposits and selected assets of UT Bank Ltd and Capital Bank Ltd to GCB Bank Ltd.”

In the statement announcing the ceding of the management of UT and Capital Banks to GCB Bank Limited, the Central Bank stated that “GCB Bank Ltd was selected amongst 3 others on the basis of purchase vice, cost of funding, branches to be retained, staff to be employed and impact on the acquiring bank’s capital adequacy ratio” – which HFC bank happened to be one.

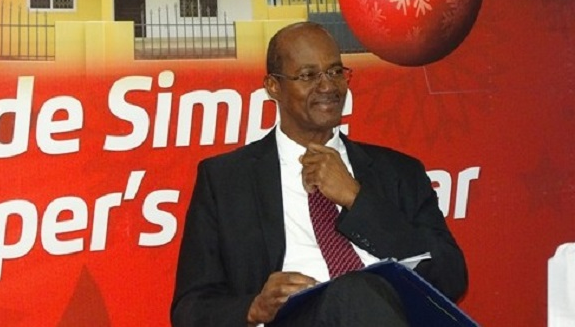

“I don’t think it is any secret that when UT and Capital banks ran into problems and the bids from the Central bank were brought to the banking community, HFC or Republic bank was only one of the three banks who have put up bids to purchase UT and Capital banks,” Mr. Jordan divulged Wednesday at a Breakfast meeting with journalists.

“We actually brought due diligence people from Trinidad and Tobago to spend time at UT and Capital banks and we did put in a bid. For whatever reasons…I can’t comment the banks were awarded to GCB [bank] and we respect that decision of the regulator,” he added.

Despite failing to acquire UT and Capital banks, Mr. Jordan hinted that should a similar opportunity avail itself, the bank will not hesitate putting up a bid.

“Primary responsibility for distressed banks in any country rests with the regulatory authorities,” he said, “but if an opportunity presents itself and we at…I should say not so much HFC bank but Republic Bank Financial Holdings where we think we can help and add value and it will be beneficial for all concerned then we will get involved and make an offer or reach out.”

We can meet capital requirement

Touching on the recently hiked minimum capital requirement, Mr. Jordan said HFC bank is in a strong position to it.

The central bank last year raised the minimum capital requirement to GH¢400 million, equivalent to about US$100 million and commercial banks in the country have up to December 2018 to raise the amount, which represents a 333.3 per cent increase from the current minimum capital of GH¢120 million.

Banks were last recapitalized in 2012, when the BoG asked them to raise their stated capital from GH¢60 million at the time to the current GH¢120 million.

That round of recapitalization led to the consolidation of three banks, The Trust Bank (into Ecobank), Intercontinental Bank (into Access Bank) and Amalgamated Bank (into Bank of Africa).

“We have all the resources to meet the capital requirement,” he said as the bank has strong backing from its majority shareholders Republic bank financial holdings and SSNIT.

Source: Ghana/Starrfmonline.com/103.5FM