Since 2018, the Governor of the Bank of Ghana and the Minister of Finance started drumming into the ears of Ghanaians about cleaning up the Savings and Loans sector. These announcements resulted in undue pressure on the Savings and Loans sector as depositors panicked and hence started trooping into the banking halls of Savings and Loans companies to withdraw their monies. This increased the liquidity challenges being faced by the Savings and Loans Companies which had already been occasioned by the earlier closure of some universal banks.

The Central Bank gave assurances to depositors that no depositor will lose his/her money during the clean-up exercise. On the 16th of August, 2019, the day of the revocation licenses of 15 Savings and Loans Companies and 8 Finance houses, the statement issued by the Central Bank stated in part “In line with the Government’s commitment to protect depositors’ funds, the Government has made funds available to enable the Receiver pay depositors after their claims are validated. The Receiver will in due course make an announcement with regards to when and where payments will be made,” Graphic online.com.

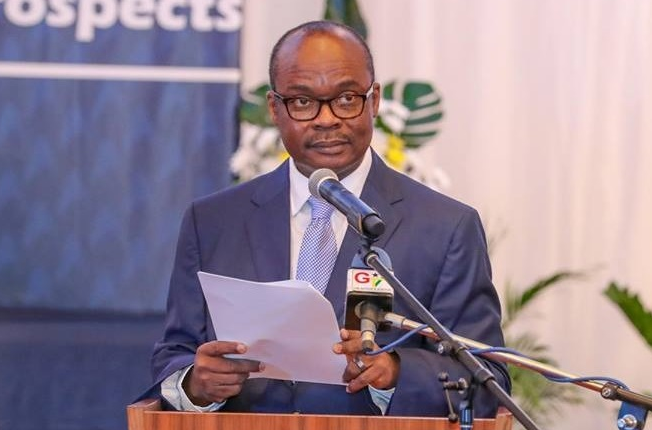

Prior to the exercise, the governor of the Bank of Ghana Dr. Addison said on the 15th of April, 2019 thus “We see the cost of the clean-up of the micro-finance sector as not that much, compared to what we are seeing in the Savings and Loans and the other finance houses, which is about GH¢7 billion. We have done our analysis and the estimate of the clean-up of the sector is about GH¢7 billion, which we have to find to complete the process. The engagement will ensure that the necessary funds can be raised on the part of the government to cushion depositors of these institutions,”

The Finance Minister Ken Ofori-Atta on the 19th of June 2019 at Malabo

said “the government is currently working to secure the required funds to aid this exercise by the regulator.”

Speaking to JoyBusiness in Malabo, Equatorial Guinea at the just ended African Development Bank Annual Meetings, Mr. Ofori-Atta said their action would be guided by lessons from the previous cleanup.

Mr. Ofori-Atta said, it has been a very expensive exercise, “in all we’ve spent GH¢12 to GH¢14 billion already and that’s really a stretch on our budget but somehow we’ve been able to do that.”

He added, “I think we are going to spend somewhere around a billion for the MFIs and that’s ongoing, I think it’s gone well so far and then we need to tackle the S&Ls. We are hoping before September; so we are gearing ourselves up to find the resources for that.” myjoyonline.com

The finance Minister on the 3rd of September, 2019 said “government has already spent ¢14 billion to clean up the savings and loans sector.

Speaking at the 56th annual session of the Ghana Baptist Convention in the Ashanti Region, the Minister said much of the money will go into paying disgruntled depositors.” Myjoyonline.com.

Interestingly, according to report obtained from the Ghana Association of Savings and Loans (Ghasalc) website, the total assets of all the 38 Savings and Loans Companies as at 31st December, 2018 was GHS 6.83 billion and total outstanding public deposits / borrowings stood at GHS 5.52 billion. It is obvious that since the beginning of the year 2019, the Savings and Loans industry has not been growing in terms of deposit and lending.

Now the big Question is if total deposits of all the 38 Savings and Loans was GHs 5.52 billion; How can the finance minister spend GHS 14 billion on the revocation of 15 Savings and Loans and 8 finance houses? Meanwhile, the Governor of Bank of Ghana in April said that their estimate for the Savings and Loans and the Finance houses was GHS7 billion.

Just recently on the 31st of October, 2019, the Finance Minister Mr. Ken Ofori-Atta said on Peace FM that government will only cushion each depositor with a sum of GHs 10,000 and the remaining balance of each depositor may be paid after the receiver has recovered from disposals of assets and loans.

Is the Finance minister implying that an exercise which was estimated to cost GHs 7 billion, he has spent twice the estimated amount yet they could not pay depositors in full but just Ghs 10,000.00? So where did the GHs14 billion go?

On the 25th September 2019, The Head of the Banking Supervision at the Bank of Ghana said “4.6m depositors were saved in a recent banking cleanup exercise. The banking sector is made up of banks, savings and loans, finance houses, the microfinance institutions, and microcredit institutions, and all these are affected so you need to aggregate all the institutions whose licenses were revoked across the tiers and if you put all these together you get 4.6 million depositors,” myjoyonline.com. How have depositors been saved if all the money he/she could get from his/her deposit of say GHs 1 million is Ghs10,000.00?

I think it is time for the good people of Ghana to ask questions and demand answers from people in authority who want to take us for granted.

Are depositors going to sit down quietly for their hard earned deposits to go down the drain? When the Governor of the Bank of Ghana and the Finance minister assured them they are securing funds to pay depositors and later settle their liability from the disposals of assets and loans recoveries?

Has there been a Recievership or a Decievership?

The writer is a chartered Accountant and an Industry watcher