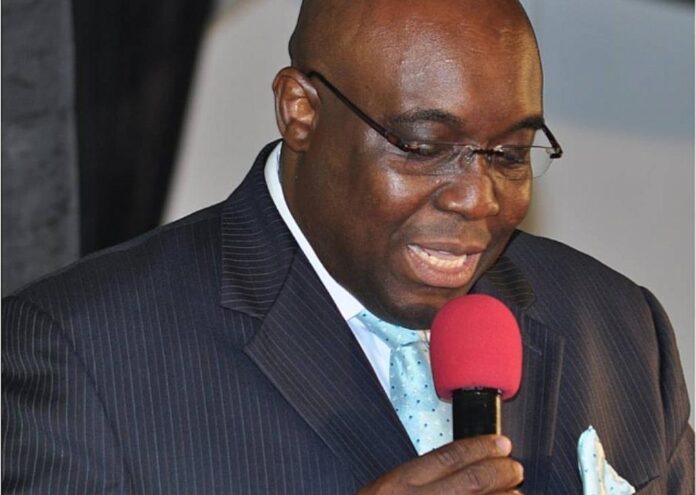

The Managing Director of the Bank of Africa Ghana, Mr. Kobby Andah, has called on SMEs to keep proper and accurate records to enable them to prove to Banks that they are worthy to be considered for credit.

“Most SMEs face difficulties in raising adequate and affordable credit from banks due to their inability to meet credit prerequisites”, he said, adding “and they end up borrowing mainly short-term and expensive funds which tend to limit their growth potential”.

Mr. Andah urged SMEs to capitalize on the digitalization agenda of the Government and minimize cash transactions. He raised concerns on the structure of SMEs in Ghana where most are individually owned.

Decision-making is thus concentrated on one person making transparent governance and business succession weak and poor. He further spoke on the need for Enterprises to plough back some of their profit into the business to increase their stake since Banks are more likely to support businesses whose owners have a larger interest in the business.

He made the comments during an SME forum held by the Ghana National Chamber of Commerce & Industry on Wednesday, 25th August 2021 at the La Palm Beach Hotel under the theme: “Redefining Business Success: The Case of SMEs in Ghana.

Present at the forum were Honorable Akosua Frema Osei-Opare (Chief of Staff,) Honorable Nana Dokua Asiamah Adjei (Dep. Minister of Trade & Industry), and Mr. Clement Osei-Amoako, the Chairman and President of the Ghana National Chamber of Commerce and Industry.

Mr. Andah encouraged Banks to aid SMEs upscale their enterprises into large corporate Institutions by providing advisory services and also take a critical look at the interest rates charged on loans. He gave an example of how the Bank of Africa has designed a product specifically for SME businesses in its quest to promote and grow the SME segment.

The Bank is currently granting loans in excess of GH¢250,000.00 without collaterals and financials to SME businesses. He believes such bold steps by the bank would help grow the segment which eventually will help grow the Ghanaian economy.

On the side of the government, Mr. Andah applauded it for all the good initiatives it had rolled out to support the SME sector. He touched on the benefits of initiatives such as the establishment of the Ghana Enterprises Agency and the 67 Community Business Resources Centers.

He however noted that many at times, these support schemes do not work as expected or are not sustainable because beneficiaries regard the funds as free money. To curb this, he advised Government to improve the criteria for the selection of beneficiaries and to put in place monitoring agencies who would follow up on the post-support conditions. He also besought on Government to assist banks easily verify the creditworthiness of SME businesses by establishing Credit Rating Agencies with the sole aim of smoothening out the current information asymmetry between SMEs and banks.

To end his speech, Mr. Andah challenged the Ghana National Chamber of Commerce and Industry and other association bodies for SMEs to organize and assign collaborators to follow up, assist and monitor the progress of their members as far as setting up the right structures is concerned.

SMEs were also advised to work hard and put proper structures in place to stay ahead of competition especially because of the influx of products from our neighboring countries.

Source: Ghana/Starrfm.com.gh/103.5FM