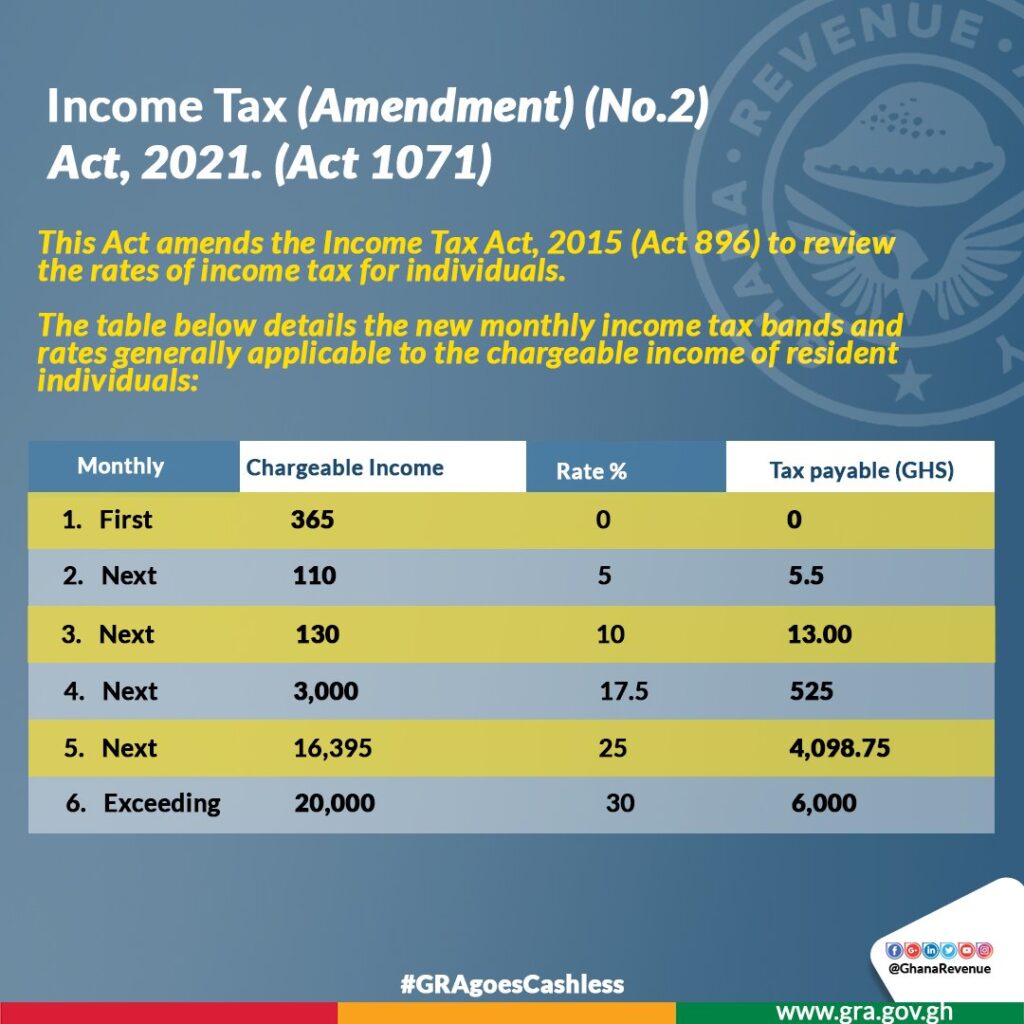

The Ghana Revenue Authority (GRA) has indicated that Ghanaians with income of Ghc365 would not be taxed.

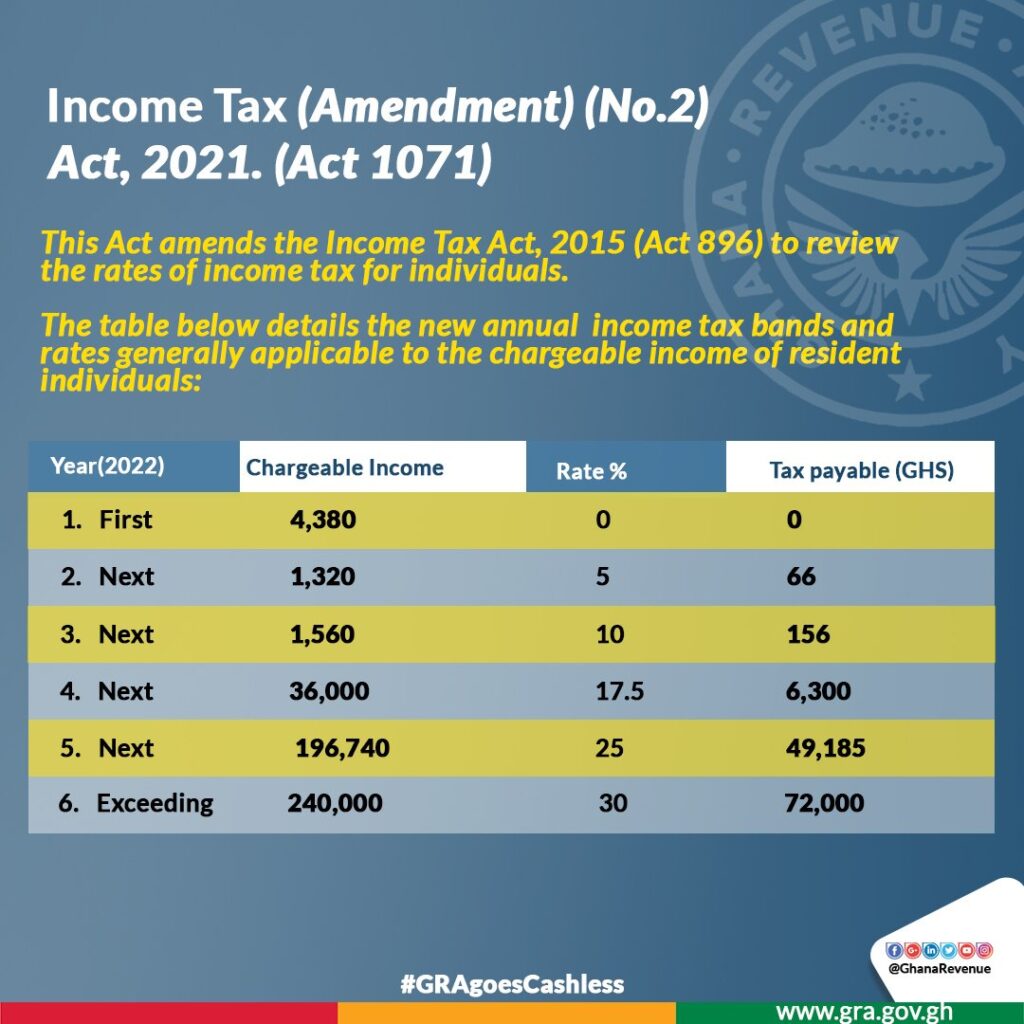

According to the GRA, the move is as a result of the amendment of the Income Tax Act, 2021 (Act 1071).

The Authority explained that chargeable income is made up of income from employment, business or investment less any allowable deduction adding that “chargeable income from each source of income is determined separately.”

“We are happy to inform you that, with the amendment (no. 2) of the Income Tax Act, 2021 (Act 1071), any employee (worker) who receives Ghc365 and below as monthly salary or Ghc 4,380.00 as annual salary is taxed at 0%.”

Attached are the tax rates

Source: Ghana/Starrfm.com.gh/103.5FM/Isaac Dzidzoamenu