Finance Minister Ken Ofori-Atta says a good number of Africa countries are facing food and other forms of severe inflation.

According to him, most finance Ministers on the continent are dreading inflation in relation to food, fuel and financial conditions.

“Today, 41 African economies are severely exposed to, at least, one of three concurrent crisis: rising food prices, rising energy prices, tightening financial conditions.

“That is just a ripple through in all Africa, and food prices easily about 34 per cent higher, crude oil prices some 60 per cent higher, and global inflation has risen; we saw our numbers yesterday moved to 23.6 per cent, a good chunk of it being imported inflation,” he said at a press conference in Accra on Thursday.

Meanwhile, year on year inflation rate for the month of April 2022 stood at 23.6%, the highest recorded in more than 18 years.

This represents an increase by 4.2% over the 19.4% recorded a month ago. Ghana last recorded similar inflation rate in January 2004 at 28.95%.

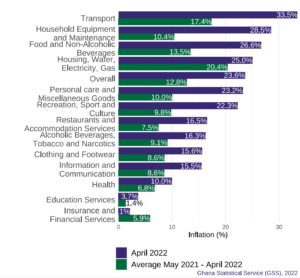

According to the Ghana Statistical Service (GSS), Transport, Household Equipment and Routine Maintenance, Food and Non-Alcoholic Beverages, Housing, Water, Electricity, Gas and Other Fuels recorded inflation rates above the national average of 23.6% with Transport (33.5% ) recording the highest inflation.

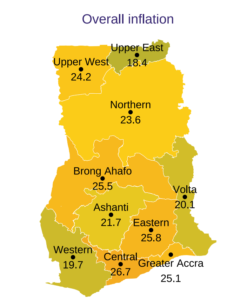

Central region maintained its position as the first of 16 regions with an overall year-on-year inflation rate of 26.7%. Per the figures released by the GSS, Upper East Region recorded the lowest change in prices with a rate of 18.24%.

Although Food inflation(26.6%) was higher than the March 2022 figure of 22.4%, its contribution to total inflation however, decreased from 51.4% in March 2022 to 50.0% in April 2022.

Non-Food Prices jumped 4.3% in the month to 21.3% with Only one out of the 12 Non-food Divisions having the 12 months rolling average to be higher than the year-on- year inflation for April 2022.

Government Statistician, Professor Samuel Annim, announced Wednesday, May 11,2022 , that for the first time in 29 months imported items surpassed locally produced items.

“As was indicated, this is the first time that imported inflation (24.7%) has in the last 29 months recorded inflation rate surpassing domestic inflation (23.0%) with a difference of 1.7 percentage points. This was as a result of the increase of about 7.4 percentage points for imported inflation between the month of March & April 2022, and about 3 percentage points from the perspective of the domestic inflation, jumping from 20.0% in March 2022 to 23.0% in April 2022 ” , he revealed.

The Monetary Policy Committee (MPC) of the Bank of Ghana increased the policy rate by 250 basis points to 17% – the first since November 2021 to check inflation after its 105th meeting in March.

“The risks in the outlook for inflation are on the upside and include petroleum price adjustments and transportation costs, and exchange rate depreciation. Under these circumstances, the committee has decided to increase the policy rate by 250 basis points to 17 percent. The Bank’s latest forecast still depicts an elevated inflation profile in the near term, with inflation falling within the medium-term target band within a year”, BoG Governor, Dr Ernest Addison revealed.

With its next MPC meeting scheduled for May 23,2022, and an 18-year high inflation rate to deal with, it remains unclear what next steps the Central Bank will take.

About the Inflation rate

Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.

It can occur when demand for certain goods and services is greater than the economy’s ability to meet those demands (supply). Other factors such as increase in input cost buy Producers, increase in money circulating within the economy, among others influence the inflation rate of a country as well.

Inflation can be a concern because it makes money saved today less valuable tomorrow. In essence, more units of the Ghana Cedi chasing fewer goods.

Source: Ghana/Starrfm.com.gh/103.5FM