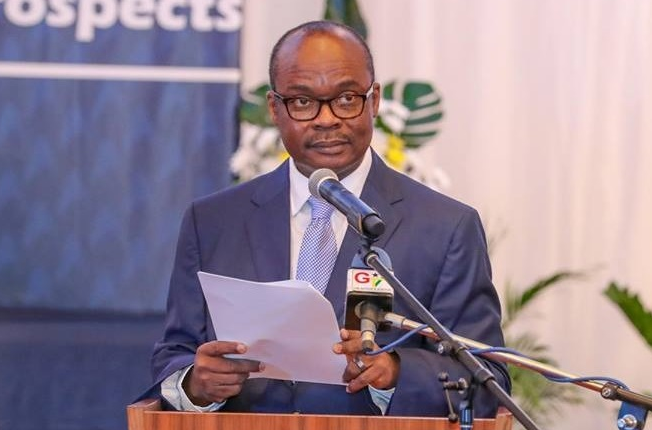

Members of the Ghana Association of Savings and Loans Companies are expected to hold a crunch meeting with the Governor of the Central Bank Dr. Ernest Addison Tuesday over the proposed increment in the sector’s minimum capital requirement.

There are reports that the current GH¢15 million minimum capital requirement will be raised to about GH¢50 million by the end of the Year. Other sectors in Ghana’s financial space have had their minimum capital increased.

The Ghana Microfinance Institutions Network (GHAMFIN) has warned that at least 289 microfinance companies are likely to be out of business if the BoG does not extend the deadline for the new minimum capital requirement for players within that space.

According to GHAMFIN, just about 30 out of the 319 microfinance companies are in good standing.

In a separate development, the Securities and Exchange Commission (SEC) is planning to increase the minimum capital of investment banking from GHC 100, 000 to GHC 5 million.

Starr Business has seen a document notifying all investment banking firms about the intention of SEC.

SEC is expected to make an announcement soon and will give timelines for the firms to meet the capital requirement or lose their license.

But some stakeholders in the investment bank space have described the proposed 4900% increase as astronomical.

As a result, through their Association, they are drafting a proposal to explain why the proposed increase will not only collapse more than 50% of investment banking firms but also further discourage the already depressed savings culture in the country.

One of the proposal from Investment Bankers is for the amount to be reduced and staggered over some years.

Source: Ghana/Starrfmonline.com/103.5FM