The Monetary Policy Committee of the Bank of Ghana has maintained the policy rate at 16 percent.

The decision, according to the Committee, was influenced by the accommodative monetary policy stance by most advanced economies which broadly offers some scope for favourable global financing conditions.

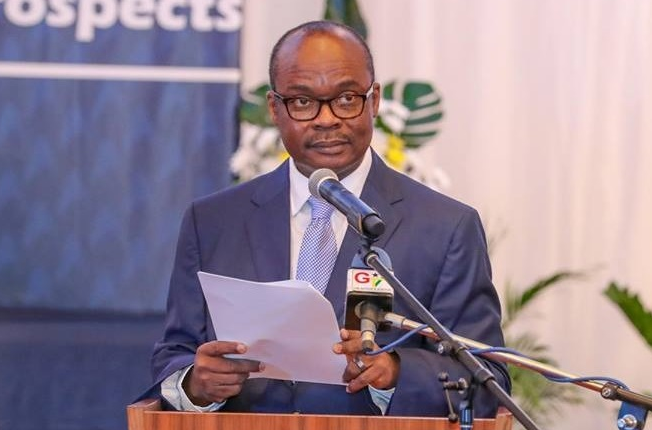

“This could have positive implications for emerging market and frontier economies with strong macro fundamentals as investors search for higher yields. These developments could impact positively on Ghana through the trade and credit channels,” the governor of the Central Bank Dr Ernest Addison said at a press conference on Monday to present the highlights of the 88th MPC meeting.

He said economic growth remains steady and is projected to gain some additional momentum over the horizon, supported by crude oil production on the domestic front as early indications already showed that economic activity in the first quarter is picking up pace as evidenced by the Bank’s CIEA.

That notwithstanding, Dr Addison said the committee observed that implementation of the budget in the year to April 2019, showed continued challenges with revenue mobilization alongside increased pace of spending which poses some risks to the fiscal outlook.

He said expenditure pressures had been exacerbated by payments associated with the energy sector. “These are exerting financing pressures on government and more stepped-up efforts would be required to ensure total realignment of expenditures to revenues.”

The Committee, he said observed strong external sector developments in the first quarter, emanating from a strong trade surplus outturn and improved inflows into the capital and financial account.

“In the outlook, the trade balance is expected to record surpluses, bolstered by the oil sector and a pickup in private transfers to support an improving current account balance. However, there are also significant outflows associated with energy-related debt, bond maturity and coupon payments which would have to be managed over the rest of the year,” Dr Addison said.

On the inflation outlook, the Committee noted that the recent exchange rate pass-through has slowed the disinflation process, leading to a slightly elevated inflation profile as shown in the latest forecasts. However, core inflation remains subdued and inflation expectations fairly anchored, he stated.

Source: Ghana/Starrfm.com.gh/103.5FM