Economist and Dean of the School of Business at the University of Cape Coast, Professor John Garchie Gatsi has called on the government to “pause and moderate borrowing” to avert a looming debt crisis.

“The first thing is to pause and moderate borrowing. When we do borrow, this should be directed to quality disbursement. We are not able to ensure quality disbursement of our debt”, he said.

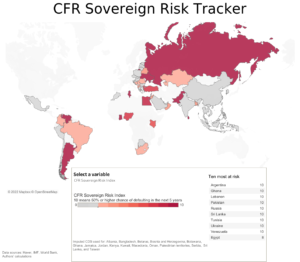

His comment follows the Council on Foreign Relations’ (CFR) gloomy picture of Ghana’s Debt sustainability.

According to the CFR’s latest Sovereign Risk Tracker, Ghana is among 10 countries globally, including Argentina, Lebanon, Pakistan, Russia, Sri Lanka, Tunisia, Ukraine, Venezuela and Egypt, that are at risk of debt distress. Per the metrics used, Ghana has a higher chance of defaulting in the next five years.

This review is the latest addition to similar suggestion from the World Bank on Ghana’s Sovereign Debt. Earlier in March, the bank warned that Ghana was in a tighter corner with respect to financing and interest payments and faces a very tough road ahead to restore macro sustainability.

“It’s a really serious situation, and at the World Bank, we’ve not hidden the fact.“ Country Director, Pierre Laporte, said at the One Ghana Movement lecture held on March 7,2022.

Asked of the extent to which he agrees or disagrees with this rating, Professor Gatsi said : “Our Debt level is having a toll on Financial Management for the country and is creating a situation whereby after dealing with repayment of interest and amortization, we are unable to commit ourselves in an acceptable manner relating to investment in public infrastructure and the economy in a way that will create jobs for the people. We are not able to do things that we should have been able to do due to this level of debt”, he said.

“The cost of executing government projects has also gone up significantly and if those projects are able to go through, they will go through on the back of arrears. These are the challenges we are facing. The most painful aspect of all of this is that, if we are increasing the level of debt compared to the size of the economy, because we are doing so to invest in critical strategic areas of the economy which will by themselves contribute to economic gain for job creation, revenue mobilization, that will not be a problem for the economy but we are doing this on the back of poor export agenda, low revenue generation, weak creation of jobs , by whatever level of economic growth we attain ” Prof Gatsi lamented.

Ghana’s public debt stock went up by GH¢40.1 billion to GH¢391.9 billion at the end of the 1st Quarter this year according to the latest Summary of Economic and Financial Data by the Bank of Ghana. Of this figure is a GH¢189.9 billion Domestic debt (37.8% of GDP) and GH¢201.9 external component (40.2% of GDP) of the total public debt.

Professor Gatsi has however not Ruled out the option of debt restructuring as sought by Sri Lanka who already is in Debt default but emphasized the need for programs that will be attractive to bilateral creditors if this is to happen.

“We should put in place programs that will be attractive to our bilateral creditors so it is easy to talk to them to see if they can help us to restructure our debts. We cannot do that for the commercial holders of our bonds” , Professor Gatsi advised.

Ghana’s economy has been bedeviled with rising food and energy prices pushing inflation to an 18-year-high of 23.6%. With the central bank in focus, the Monetary Policy Committee (MPC) increased the rate at which it lends to commercial banks by 200 basis points to 19%. A move leading to higher lending rates on the local market and higher costs of doing business as it remains unclear what the government intends to do to cure inflation.

With investors betting on Ghana defaulting in repaying debts, much is left to be concerned with about the fiscal burden on the citizenry.

Source: Starrfm.com.gh/103.5fm/Emmanuel Agyabeng