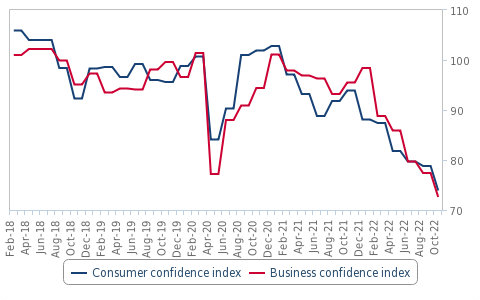

We at Fitch Solutions forecast real GDP growth in Ghana to slow to 2.9% in 2023, from an estimated 3.3% in 2022. Data released by Ghana Statistical Service shows that real GDP growth weakened significantly in Q322, to 2.9% y-o-y, from 4.7% in Q222. While the mining sector recorded robust growth of 14.9%, a 7.4% contraction in the manufacturing sector and a 7.0% decline in the construction industry weighed on overall economic activity. Given strong price pressures – inflation averaged 48.3% in Q422 – and weak private sector sentiment (see chart below), we believe that economic activity will have slowed further in Q422, informing our estimate that real GDP growth fell well below its five-year pre-pandemic average of 5.3% in 2022.

Weak Sentiment Points To Further Slowdown

Ghana – Private Sector Confidence

Note: Values below 100 indicate a pessimistic attitude towards future developments in the economy. Source: Macrobond, Bank of Ghana, Fitch Solutions

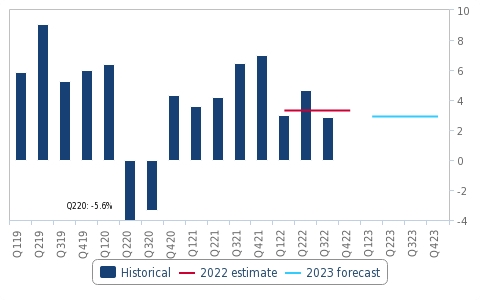

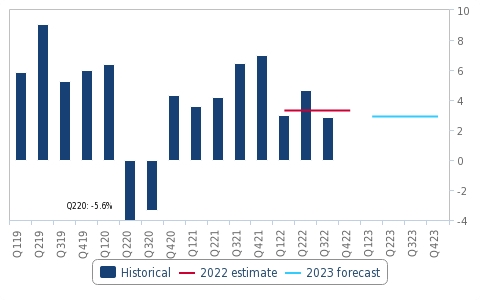

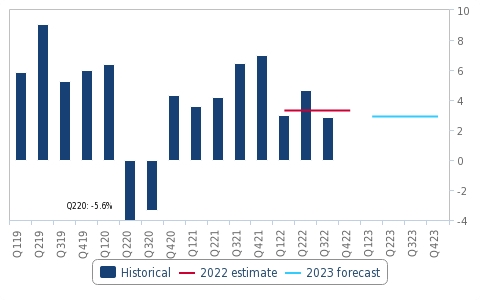

We expect economic activity to slow further in 2023. Despite tailwinds from anticipated production increases in Ghana’s most salient export products, tighter fiscal and monetary conditions as well as still-strong price pressures will weaken domestic demand over the coming quarters.

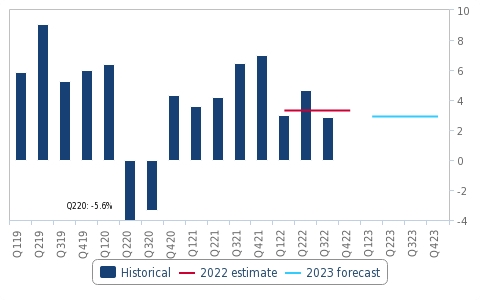

Economic Activity Will Slow In Coming Quarters

Ghana – Real GDP Growth, % y-o-y

Note: Fitch Solutions estimate/forecast. Source: Ghana Statistical Service, Fitch Solutions

Net exports will be the driver of Ghana’s economy in 2023. Production increases in the country’s most prominent commodities – gold, oil and cocoa – will bolster export growth. Indeed, our Mining team projects that growth in gold output will remain healthy following the recommissioning of the Bibiani mine, as well as efforts to formalise artisanal and small-scale gold mining, while our Agribusiness team forecasts robust growth in cocoa production as favourable weather conditions in Q422 are likely to result in a strong harvest. At the same time, subdued private sector activity amid still-high inflation and rising taxes will lower import demand, and thus improve Ghana’s trade balance. Taking these various dynamics into account, we project that net exports will add 2.1 percentage points (pp) to headline economic growth in 2023, up from 1.7pp in 2022.

Net Trade To Support Ghana’s Economy In 2023

Ghana – Contribution To Real GDP Growth, pp

e/f = Fitch Solutions estimate/forecast. Source: Ghana Statistical Service, Fitch Solutions

A decline in real incomes will weaken consumer activity in 2023. We anticipate a disinflationary trend in 2023 – with price growth averaging 33.4% (see chart below). We see the currency stabilising as the country’s external debt restructuring process becomes clearer and the IMF Executive Board approves the USD3.0bn programme that reached staff-level agreement in December 2022. Inflation will only come down gradually in 2023 as tax hikes – including an increase in the value-added tax to 15.0%, from 12.5% previously – will exert upward pressure on consumer prices. Other fiscal consolidation measures, such as the introduction of an income tax bracket of 35.0%, will further squeeze household finances in 2023. We forecast private consumption growth to slow to 2.4% in 2023, from an estimated 2.8% in 2022, adding 1.6pp to headline economic growth.

Strong Price Pressures Will Continue To Squeeze Household Finances

Ghana – Consumer Price Inflation, % y-o-y

Note: Fitch Solutions forecast. Source: Macrobond, Ghana Statistical Service, Fitch Solutions

Fixed investment growth will slow on weaker access to credit for businesses. In 2022, the Bank of Ghana (BoG) hiked the policy rate by a total of 1,250 basis points to 27.00%, making it one of the most hawkish central banks globally. With inflation remaining elevated, we believe that the BoG will continue to tighten monetary policy in 2023, bringing the policy rate to 29.00% by year-end. This will further restrict private-sector borrowers’ access to credit, likely delaying corporate investment plans and weighing on fixed capital formation over the year. Furthermore, banks will face significant pressure on their balance sheets in light of Ghana’s planned domestic debt restructuring programme – under which domestic investors are being asked to exchange their existing securities for new ones – weakening their ability to issue loans to corporates.

Weaker Access To Credit To Weigh On Fixed Investment

Ghana – Average Lending Rates & Private Sector Lending

Source: Macrobond, Bank of Ghana, Fitch Solutions

Public investment is also likely to remain weak in 2023. While the government aims to double nominal capital expenditure from a budgeted GHS13.7bn in 2022 to GHS27.7bn in 2023, we believe this is unattainable. Ghana faces both external and domestic borrowing constraints, with a debt restructuring programme likely to make domestic banks more cautious in lending to the government in 2023. As such, we believe that public investment will come in substantially weaker than the official target. Taking these various dynamics into account, we project fixed capital formation to expand by 2.6% in 2023, down from an estimated 3.0% in 2022, adding just 0.5pp to headline growth.

Risks To Outlook

Risks to Ghana’s economic outlook are heavily tilted to the downside. On January 10 2023, Ghana’s finance ministry announced that it will seek debt treatment under the G20 Common Framework. This has proven a protracted process for other countries that have applied (including Zambia and Ethiopia), and we believe that the IMF’s Executive Board will likely delay its final approval of Ghana’s programme by a few months. There is a risk, however, that the approval takes longer, which would weaken market sentiment, weigh on the exchange rate and keep inflation higher for longer. In this eventuality, economic growth would soften further than our current 2023 forecast assumes.

Source: Fitch