Plans by HFC Bank Limited to increase its capital level by Ghc50 million could be delayed with the absence of a board at the Securities and Exchange Commission (SEC).

The bank has been given the go-ahead by its board to inject the said amount into its operations, subject to approval by shareholders. The SEC Board would have to also approve the transaction before it is presented to the shareholders.

The Bank of Ghana requires all commercial banks in the country to have a minimum capital of GHc120 million by the end of 2017. The bank has so far raised Gh¢ 96 million of that amount and is hoping to be given the green light to bring in more funds to meet the deadline.

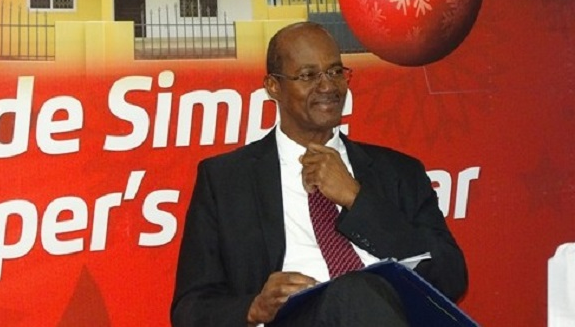

Addressing journalists on the back of the bank’s half year performance, the Managing Director of the bank, Robert Le Hunte said: “We are presently at GHc96million and we are looking to ensure that we reach that GHc120 million. That is the first hurdle. It needs to be approved by the SEC. The reality is that the SEC does not have a board of directors in place.”

According to Le Hunte, SEC’s approval is necessary because the company is a publicly listed one. He fears that any further delays on the part of government to constitute a board at the commission, could affect the bank’s ability to meet the GHc120 million requirement.

“Our ability to bring that capital and therefore meet the bank of Ghana requirement will be dependent on the SEC putting up a board of directors and approving our documentation,” he warned.

RETURN TO PROFITABILITY

The bank recorded a 52 percent increase in its profit after tax as at the end of June 2017; the highest half year result in its history. This feat follows two years of losses and GHc150million in provision.

Le Hunte believes the approach adopted by the bank over the past couple of years is paying off.

“HFC is in a good place. We have taken a lot of hard decisions in the past and some of them are unpopular decisions; not many people would have put out results that are showing losses. We have done that and because of the strength and confidence that people have had in us, we have done that and we have actually seen our market share grow,” he said.

HFC bank has also covered about 65 percent of its Non-Performing Loans ratio as at the end of June 2017. The MD attributed the half year performance to the “hard work of the staff and the focus on recoveries over the past two years”.

The bank was one of the hardest hit by the energy sector debts which left most banks with high Non Performing loans. The bank had been recording losses since 2015 (GHc80 million) making it unable to pay dividends to its shareholders for the past two years.

An aggressive restructuring and retooling of the bank was embarked on after it was taken over by Republic Financial Holdings in May, 2015. This led to the injection of over GHc100 million into its operations.