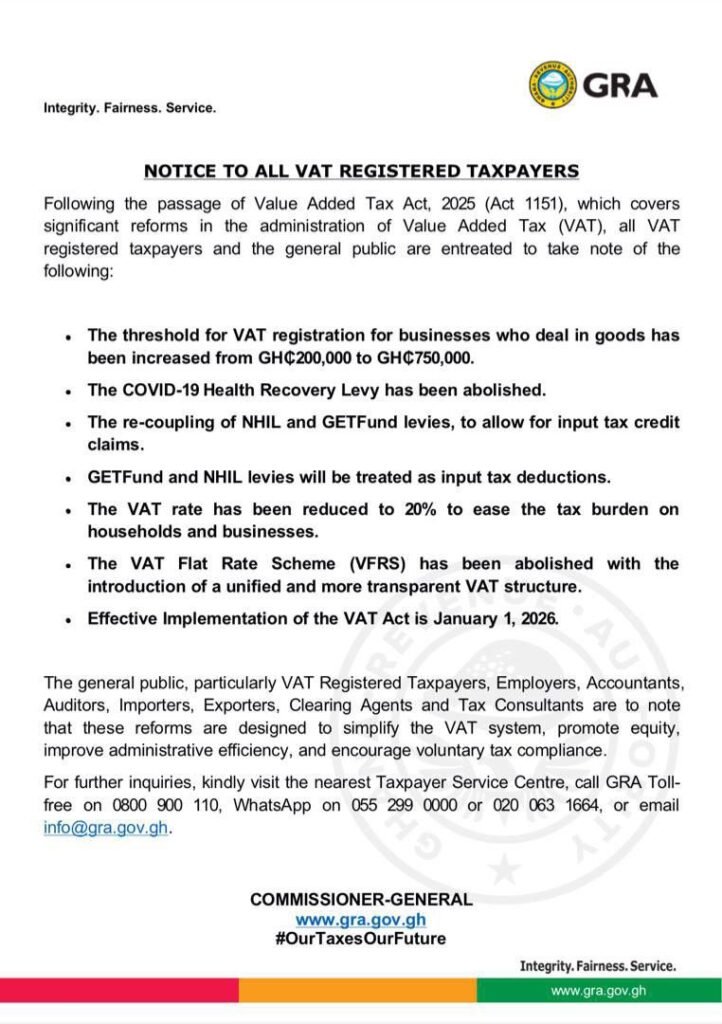

The Ghana Revenue Authority (GRA) has announced sweeping changes to the country’s Value Added Tax (VAT) regime, set to take effect from January 1, 2026, following the passage of the Value Added Tax Act, 2025 (Act 1151).

In a public notice, the GRA said the reforms are aimed at simplifying the VAT system, easing the tax burden on households and businesses, and improving compliance.

One of the key changes is a significant increase in the VAT registration threshold for businesses that trade in goods. The threshold has been raised from GH¢200,000 to GH¢750,000, a move expected to exempt many small businesses from mandatory VAT registration.

The Authority also announced the abolition of the COVID-19 Health Recovery Levy, which was introduced during the pandemic. In addition, the overall VAT rate has been reduced to 20 per cent to provide relief to consumers and businesses.

Another major reform is the scrapping of the VAT Flat Rate Scheme (VFRS), which will be replaced with a unified VAT structure. According to the GRA, this new system will be “more transparent” and easier to administer.

The reforms also include the re-coupling of the National Health Insurance Levy (NHIL) and the GETFund levy, allowing businesses to claim input tax credits. Under the new system, both NHIL and GETFund levies will be treated as allowable input tax deductions.

“The reforms are designed to simplify the VAT system, promote equity, improve administrative efficiency, and encourage voluntary tax compliance,” the GRA stated.

The Authority urged VAT-registered taxpayers, employers, accountants, auditors, importers, exporters, clearing agents, and tax consultants to familiarise themselves with the changes ahead of their implementation date.

The GRA advised the public to contact its Taxpayer Service Centres or use its toll-free and digital platforms for further clarification on the new VAT regime.

Below is a copy of the statement

Source: Starrfm.com.gh