The Executive Director of policy think tank, Alliance for Social Equity and Public Accountability(ASEPA), Mensah Thompson has described as cruel, reasons adduced for the collapse of several institutions by the Central Bank under the guise of financial sector clean-up.

Presenting what he describes as fresh evidence after careful scrutiny of reasons adduced, Mr Thomson said the decisions by the government through the bank of Ghana are criminal and cannot be swept under the carpet while thousands of customers grieve over their locked up deposits.

Addressing a news conference in Accra on the theme “Assessing the socio-economic impact of the banking sector reforms on the ordinary Ghanaian”, the ASEPA Executive Director, said what makes the customers’ plight more painful is the false hope by President Akufo-Addo in February this year, that all those affected will receive their cash in full.

The presentation by ASEPA comes in the wake of renewed agitations by some Ghanaians who have raised concerns over the decision by the Receiver to cap how much depositors can withdraw and the mandatory 5-yr bond at zero interest for remaining amount or the option for cash at a discount payable through the Consolidated Bank of Ghana, CBG.

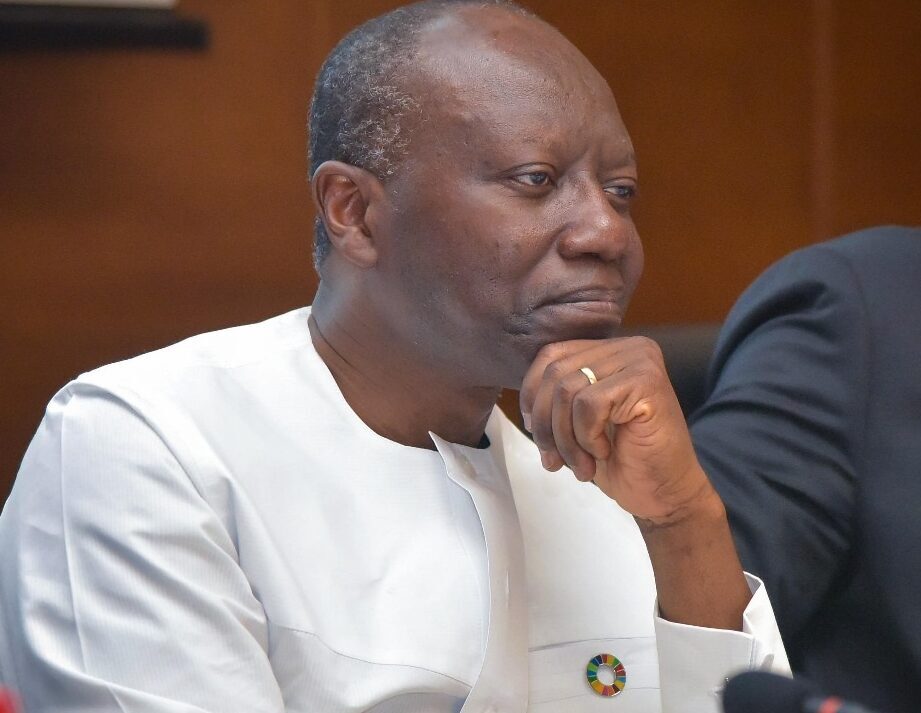

ASEPA’s presentation also made reference to the position held by government through the Finance Minister, Ken Ofori Atta who in his presentation of the 2020 budget told Parliament that the financial sector clean-up was a necessary evil and the intervention was to save depositors and investors whose funds were locked up.

ASEPA noted that in 2017 and 2018 government claimed it spent GHC11.7 billion to save depositors held by banks whose licenses were revoked.

It, however, the Central bank’s own actions, pronouncements after the closure of UT and Capital Banks, triggered panic withdrawals and the consequential actions.

“Without rationalizing the cruel nature this cleanup, the point we are making is that if the clean up was with the right intention of protecting depositors, the results would have very different,” he noted

ASEPA further observed: ”In the same report to Parliament, the cost of the clean up was pegged at GHC64.7billion that is $11.6billion. Without mincing words, we boldly contend that indeed there were systemic challenges in the sector that needed to be addressed. But it is also an indisputable fact that, some of the banks were not as weak as the Government made it look like, infact most of the weakness which the BoG stood on to revoke their licenses were artificially created distress by the BoG.”

He added: ”Again the Minister of Finance deliberately refused to pay GHC5.7 billion owed to contractors who borrowed largely from Ghanaian banks. The payment of these contractors alone would have contributed about GHC5.7 billion to the recapitalisation of these institutions including uniBank would have received GHC1 billion to survive; Royal Bank and GN Bank which would also have received in excess of GHC2.3 billion to meet the minimum capital requirements.”

ASEPA Executive Director said a critical assessment of the impact done from direct engagements with those affected indicate that 42,850 Ghanaians lost their jobs.

These include those who were directly or indirectly engaged by the collapsed 347 micro-finance companies, 39 microcredit companies, 23 savings and loans and finance house companies since 2017.

Giving the breakdown, Mr Thompson said 4,500 direct and 2,000 indirect jobs were lost from the revocation of 16 bank licenses; 4,000 direct and 3,800 indirect jobs after the revocation of licenses of 23 Savings and Loan companies nationwide; 17,350 direct and 10,000 indirect jobs created by the collapsed Microfinance Institutions (MFIs) in Ghana and 1,000 direct and 500 indirect jobs with 53 Funds Managers.

ASEPA blamed government and the Governor of Central Bank, Dr Ernest Addison for what he described as an unpopular cleanup exercise that failed to protect local financial institutions with its attendant impact on the lives of not only customers but staff who lost their jobs and dependants.

“18,000 workers of the affected cleanup exercise have died. 6,500 orphans are currently struggling to fend for themselves in the unbridled cleanup exercise sanctioned by the Akufo-Addo led government. Many have been ejected from their homes and the sick are unable to access their cash to access health care,” he emphasized.

He was quick to add that 9,000 of the affected workers were currently homeless, whereas 250,000 of them were also lost their livelihoods.

In justification of his conclusion that the mass financial sector clean-up exercise had ill motives, ASEPA referred to Act 930 of Bank of Ghana’s regulations and said the closure of Heritage Bank among others is one of the questionable decisions that should stun any sector player.

“On the issue of the overexposure of Seidu Agongo to Heritage Bank, which also warranted the withdrawal of the Bank’s licence, it is instructive to note that the same Bank of Ghana had given Heritage Bank three years, beginning from 2016, to dilute the shareholding of Mr Seidu Agongo down from 70 percent. When it was being diluted in line with regulatory directives, the same Bank of Ghana ignored its own advice and took down the bank. This smacks of a regulator who does not respect its own directives. But what Ghanaians do not know is that two other banks are in situations that are worse that Heritage Bank’s yet the Bank of Ghana found it prudent to save them and bring them under the support the dubious and shady GAT programme,” ASEPA explained.

He said Ghanaians must put government on its toes and pile pressure on it to raise funds as promised to pay all depositors particularly traders, small scale businesses, importers, contractors whose remaining funds are still locked up because of the Receiver’s decision to issue bonds or pay a discounted amount to those who want cash immediately.

Source: Ghana/Starrfm.com.gh/103.5FM