The shareholders of GN Savings and Loans are praying the High Court to order the Bank of Ghana (BoG) to restore their specialised deposit-taking licence.

The prayer was contained in the written address that the lawyers filed on behalf of the shareholders.

“These actions were taken pursuant to Section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a Bank or Specialised Deposit-Taking Institution (SDI) where the Bank of Ghana determines that the institution is insolvent”, the revocation notice stated.

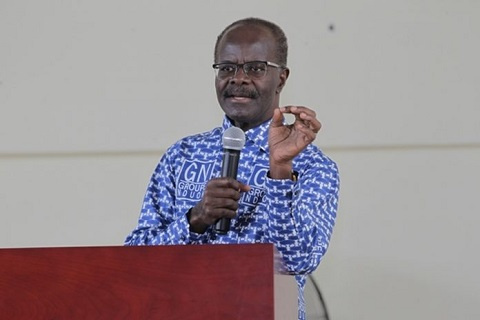

According to counsel for the shareholders, Justice Srem-Sai, the BoG failed to take the total indebtedness of the government to Groupe Nduom into account in its evaluation of GN Savings’ books.

“BoG had failed to take into account the relevant factors that it ought to”, the lawyers argued in their address which was filed on April 14, 2020.

They also argued that the BoG “has come to a conclusion which no reasonable person who is seized with all the relevant facts would have come to.”

Affidavit in support

In his affidavit filed on August 30, 2019, Dr Nduom on his part told the High Court that the government and its ministries, department and agencies owed the GN Savings more than GH¢ 600 million and not the GH¢ 30.3 million that the BoG stated in the revocation notice.

“The Bank of Ghana and the Minister of Finance deliberately diminished or distorted the total indebtedness of the government and its MDAs to the Groupe Nduom so as to enable the Bank of Ghana to revoke GN Savings’ licence”, Dr Nduom stated in his affidavit to the Court.

Meanwhile, an applicant by the lawyers for the Bank of Ghana and the Attorney-General to have the case referred to compulsory arbitration was dismissed by the Court in December 2019.

A further application by Bank of Ghana’s lawyers to have the case stayed pending an appeal they had filed in the Court of Appeal was also dismissed as having “failed to satisfy the Court of such special circumstances warranting a stay”.

The order by the Court that the parties should file their respective addresses is a sign that the case which is running into its eighth month is about to see its end in the High Court.

Written address

In a 39-paged written address in support of the originating motion on notice for various orders for the enforcement of the fundamental human rights of the applicants, counsel argued that all evidence pointed to the fact that GN Savings was, as at the time of BoG’s decision, truly solvent; and BoG did not take into account all

the relevant factors before concluding that GN Savings was insolvent.

“In this regard, the applicants contend that not only did BoG fail to take into

account all GN Savings’ assets before concluding on its solvency, but also that

there was a malicious design by the respondents between and among

themselves to supress the value of GN assets so as to enable them to come to the

pre-determined conclusion that GN Savings was insolvent,” counsel submitted.

What follows from here, therefore, is a summary of some of the key factors that BoG and the Minister of Finance should have taken (but have, either by neglect or refusal, failed to take) into account before coming to a decision on GN Savings’ solvency.

According to the applicants, independent assessment of their books showed they were solvent adding that “all this notwithstanding, BoG, which has not conducted any known independent, fair or truthful assessment or evaluation of the GN Savings’ books – assets and liabilities – was able, quite bizarrely, to come to a conclusion that

GN Savings was insolvent and, consequently, revoked GN Savings’ licence on

August 16, 2019.”

“The Applicants’ argument, therefore, is that BoG has failed to conduct a true, fair and independent assessment of GN Savings’ books – matching the value of its total assets against the value of its total liabilities. And, indeed, if BoG had

conducted a proper, true, fair and independent audit into the books of GN

Savings, it would have known or come to the obvious conclusion that GN Savings

was solvent and, therefore, capable of meeting its debt obligations as at the time

that BoG revoked its operational licence,” the address pointed out.

Counsel further submitted that by revoking the licence of GN Savings and going

ahead to appoint a Receiver to liquidate or wind it up without complying with

the tenets of administrative justice, and failing to take into account matters of

fact which had been acknowledged by the BoG and the Minister of Finance themselves in correspondence captured on the record, the respondents have, are or are likely to deprive the applicants their right to the property in the GN Savings.

According to the applicants, the BoG’s conclusion that GN Savings was insolvent has no basis at law or in fact. “Rather, we have demonstrated that the decision was, at best, reckless, fraught with stark malice and in self-evident violation of basic public law rules. We have showed in the affidavit and the exhibits attached (refer to the schedule below) that GN Savings was not only solvent, but also that it has assets far more than its total liabilities,” counsel added.

Citing authorities to buttress its argument, counsel is accordingly praying the court to grant its reliefs because the applicants had amply demonstrated the respondents, who were mandated by law to ensure businesses thrived; acted unfairly and capriciously leading to the loss of 2,840 jobs.

Revocation

On August 16, 2019, the BoG revoked the specialised deposit-taking licences of over 20 savings and loans companies. This included GN Savings and Loans Company Limited. The reason which the BoG gave for the revocation was that GN Savings was insolvent.

However, on August 30, 2019, the shareholders of GN Savings filed a case at the High Court to challenge the BoG’s decision. The defendants in the case are the BoG, the Minister of Finance, the Attorney-General and the Receiver of GN

Source: Ghana/Starrfm.com.gh/103.5FM