The Bank of Ghana (BOG) has announced a reduction in the policy rate from 18 percent to 17 percent.

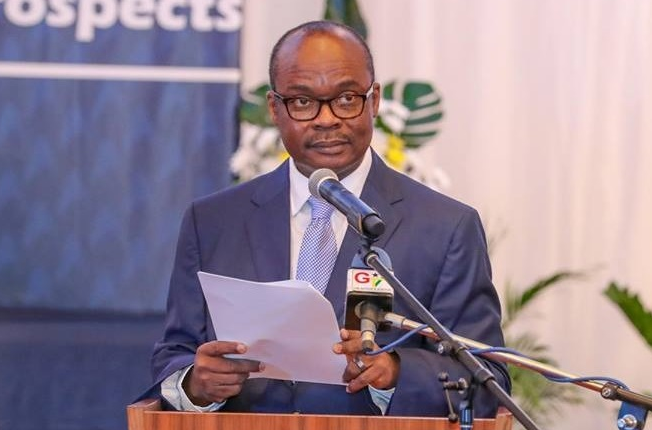

This is by 100 basis points, according to the BOG governor Dr. Ernest Addison at a press conference Monday to presents highlights of the 82nd regular Monetary Policy Committee (MPC) meeting.

Announcing the decrease, he said, “The Committee, however, stands ready to take the appropriate policy measures to address any potential threats to the disinflation path.”

Dr. Addison further observed that the foreign exchange market remains to be calm, leading to the appreciation of the cedi by 0.02 percent against the US dollar in the year to 18th May 2018 compared to a depreciation of 0.97 percent in the same period of last year.

Despite the marginal nominal appreciation of the cedi against the US dollar, he said the real effective exchange rate (in trade-weighted terms) depreciated by 0.9 percent over the first four months of the year showing that the cedi remains competitive and broadly aligned with the underlying fundamentals.

Again, noted Dr. Addison, “There is evidence to show that some stabilisation and consolidation especially with respect to inflation and exchange rate expectations are taking hold” as the fiscal and monetary policy mix and the corrective measures implemented to put the economy back on track are beginning to yield positive results.

Thus Headline inflation has declined steadily from 11.8 percent in December 2017 to 9.6 percent in April 2018, the lowest since 2013 and within the medium-term target band of 8±2 percent, he stated.

He continued that underlying inflation pressures have also been contained as reflected in the Bank’s core measures of inflation and inflation expectations.

Also, the main core inflation measure, which excludes energy and utility, declined from 12.6 percent in December 2017 to 10.4 percent in April 2018, converging toward the headline inflation, observed Dr. Addison stressing: “Evidence from the weighted inflation expectations by businesses, consumers and the financial sector also support the above.”

He said interest rates on the Money Market continues to ease and that in April 2018, rates on the 91-day Treasury bill instrument declined to 13.3 percent from 16.5 percent a year ago.

“Similarly, the 182-day instrument declined to 13.9 percent from 16.8 percent, while the 1-year note also dropped to 15.0 percent from 18.3 percent over the same comparative periods.

“Also, the weighted average interbank rate, the rate at which commercial banks lend to each other, declined further to 17.5 percent in April 2018 from 23.3 percent a year ago,” he stated.

Source: Ghana/Starrfmonline.com/103.5FM