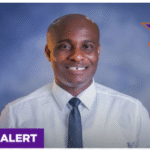

Finance Minister Dr. Cassiel Ato Forson has welcomed the Bank of Ghana’s latest monetary policy decision, describing the reduction of the policy rate to 18%, the lowest since March 2022, as a major turning point in Ghana’s economic recovery.

Reacting to the announcement, Dr. Forson said the move reflects renewed macroeconomic stability and sustained progress in reducing inflation.

“The Bank of Ghana’s monetary policy easing continues,” the Minister said, highlighting the sharp decline in inflation from 27 percent in November 2024 to 8 percent in October 2025. “This marks a drastic fall and shows that confidence in the economy continues to build.”

The central bank’s 350-basis-point cut is expected to ease lending conditions significantly. The Finance Minister noted that the decision will reduce borrowing costs, expand access to credit, and stimulate investment across key sectors.

“The move reflects renewed economic confidence, and it means lower borrowing costs, improved access to credit, and greater room for businesses and individuals to grow, invest, and create jobs,” he said.

Dr. Forson added that the policy shift signals stronger recovery momentum, setting the stage for increased private-sector activity and a more supportive environment for growth, investment, and job creation.

“The recovery is clearly strengthening, and it can only get better!”

Economists say the cut is likely to stimulate production, support business expansion, and deepen economic activity as credit becomes more affordable. With inflation now back within single digits and monetary conditions easing, analysts believe Ghana may be entering a fresh phase of economic acceleration.