Emmanuel Anyan hails a ride to work. He has no cash on him. Neither does he have enough cash on his MTN mobile money wallet to pay off a Ghc50 ride.

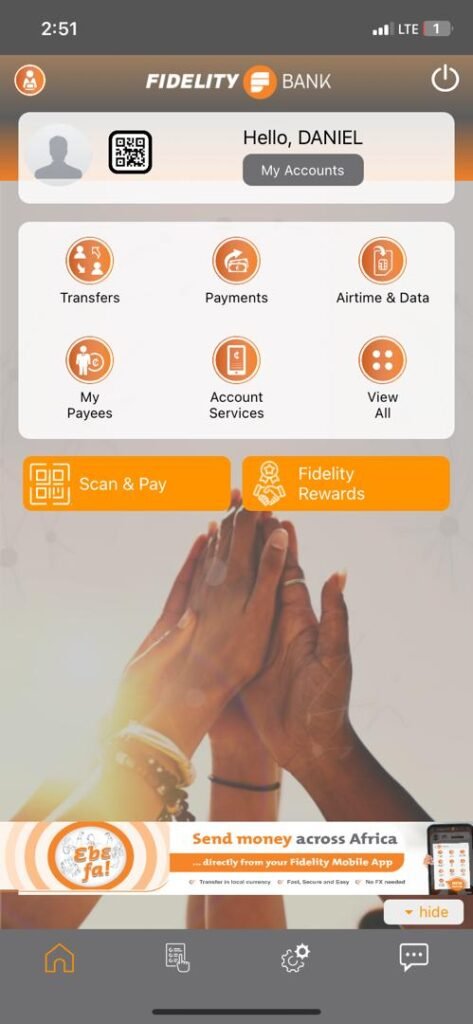

He picks up his phone, transfers money unto his mobile money wallet and gets ready to send money to the driver as payment. The driver says he has mobile money on a different mobile network but that is not a problem.

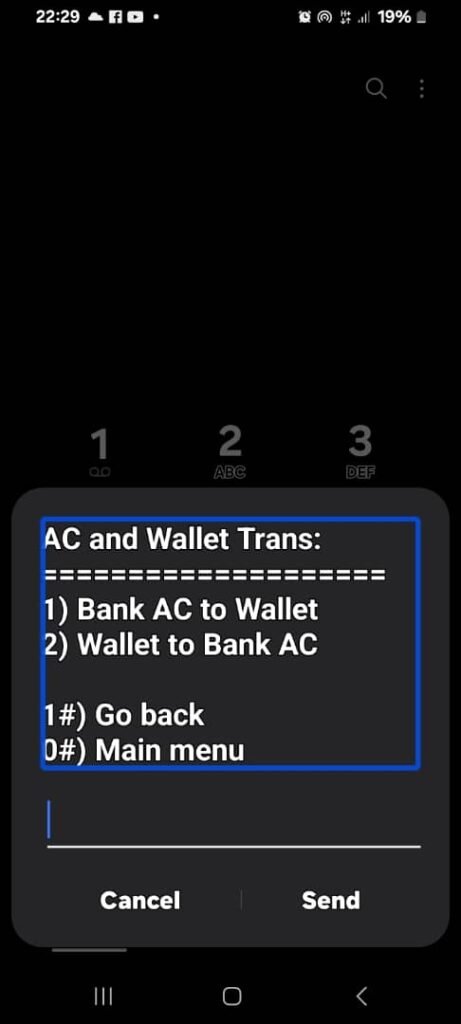

Emma is able to once again dial *170#, chose a transfer money option, choose other networks and then proceed to choose the preferred network of the driver. His transaction is done through three different systems that interact with each other.

Emma’s transfer of cash from his Bank to his mobile money wallet was successful. Then a transfer of cash from the mobile money of his network to the wallet of another mobile network operator was also possible.

Through an interoperable payment system in Ghana; he neither had to step foot in a bank or walk to an agent. All these transactions happened while he was on his way to work in a car.

Ghana’s Mobile Money Interoperability (MMI) has become one of the success stories for the fast growing instant payments ecosystems in Africa.

The Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) a wholly owned subsidiary of the Bank of Ghana, successfully launched the system in the year 2018 to allow instant electronic transfer of cash across mobile money wallets of different Mobile Network Operators, FinTech platforms and other Electronic Money Issuers.

The system which cost the central bank some US$4.5million, also allows bank to mobile wallet transactions enabling FinTech companies, Special Deposit Taking Institutions, Banks and other Financial Service Providers an opportunity to offer a number of services including loans, bill payments, remittances and insurance products to the public.

The introduction of this enhanced payment platform became such a disruptor, in just two years the volume of transfers from bank account to wallets stood in excess of 2.1 million transactions while transfers made from mobile money wallet to bank accounts hit almost 380,000 transactions.

These interoperable systems that ride on unique identification numbers and security codes to offer society wide instant payment solutions to the population come under the global umbrella concept of building Digital Public Infrastructure.

Enablers of the MMI as a DPI

Until the innovation of the mobile money interoperability platform, people would usually purchase and keep chips of different mobile networks to allow them make on-net electronic financial payments.

Alternatively, if someone wanted to transfer money to a recipient on another mobile network, the mobile money user would generate a token code and text same to the receiver who could use the code to withdraw money from a mobile money agent.

Sarah Brefo, Chief Executive Officer of SB Wig Fixes & MORE Ltd. shares how difficult it would have been, taking orders online and receiving payments from different clients who would not be naturally expected to use one mobile network.

“I would have had to have different phones for Airtel Tigo (AT), MTN and Telecel to receive payments from my clients. That would have been cumbersome. Even with the token system, you had to go cash out the money from an agent at a time we are all striving to go cashless,” she shared.

Another enabler that the Mobile Money Interoperability platform has created is competitiveness which drives down service charges and pushes players to introduce innovative products that cater to the needs of clients.

In a bid to increase its subscriber base, Telecel waived all service charges at a time Ghanaians had and still have to pay for both a 1% electronic transaction levy and a service charge of 0.75 to 1% for each money transfer exceeding Ghc100.

Though the Telecel waiver makes economic sense for most businessmen who have to do multiple cash transfers; a majority of such mobile money users would have been trapped on other mobile networks that did not offer such savings but had a huge subscriber base.

The situation is same with Nancy Boama a student of the Kwame Nkrumah University of Science and Technology who would prefer that her parents send her upkeep money through Telecel cash to spare them some savings.

“Most students use Telecel cash for two reasons. To stay off scammers because we hardly encounter them on Telecel and also because they take no charges when we send money,” she said bluntly.

Ride hailing app drivers like Attah Yeboah dreads the frustrating days of either having to use different SIM cards; securing an extra phone or swapping SIM cards to receive payments from his passengers using different mobile networks.

Mobile Money Interoperability has further created convenience and inclusion for many who found banking services either too cumbersome, discriminatory, stiff jacketed or unfriendly to their informal businesses.

Francis Manu, a teacher who is visually impaired finds it more convenient withdrawing money unto his mobile money wallet for use rather than hire a taxi and go through tedious mobility barriers to the bank just to withdraw some money.

“With my mobile phone, I can access money to make all my transactions. These days I have even downloaded the ECG app to buy power whenever I run out of electricity. We don’t need to bother ourselves as blind people going to the bank multiple times these days,” he explained.

Challenges

Despite its numerous enablers, the two most predominant challenges associated with the Mobile Money interoperability is fraud and customer redress when transactions are truncated.

Jennifer Ambolley a print journalist with the Chronicle Newspaper recounts having to wait two whole weeks to resolve a hitch after transferring cash electronically from her mobile money wallet to her bank account.

“MTN MOMO confirmed it had deducted the money so I called my bank only to be told they had not seen any cash transfer and referred me back to MOMO. MTN also told me to call my bank again. After a back and forth for a week, I was told the problem has to do with GhIPSS. It took me another week before they reversed the money,”

Imagine this was an urgent payment I had to make to meet a deadline. See the frustration, the inconvenience and the bandying of jargons like GhIPSS with very little education,” she narrated.

Fraud has taken several twists and turns in Ghana ranging across persons begging you to return monies they have mistakenly sent to you; to persons initiating cash out transactions and calling to make account holders punch in their pin to resolve a problem.

Umatu Awudu, an apprentice seamstress thought she was dealing with a credible supplier of sewing machines. She met the said supplier online while searching for a specific industrial sewing machine to buy.

The two had been in constant communication on What’s App finalizing negotiations till she transferred an amount of GHc6,500 cedis awaiting the delivery of the machine. That was the end of her sad story.

“She told me she was a Muslim like me and that she was also a mother and that I should trust her. This was the money I gathered after going for a Paralympic tournament,” she narrated in tears while speaking with me.

Unfortunately, fraudsters who scam people of their monies have also devised means to quickly divert the attention of investigations through the interoperability route.

Chief Executive Officer of the Ghana Telecoms Chamber Engineer Dr. Ken Ashigbey divulged that the miscreants immediately move the stolen cash from one network to another network sensing that the victim would call their Mobile Network to quickly freeze the transaction.

He admitted, one of the biggest challenges on the interoperability front is fraud. When they defraud you on one network, they move the money quickly to another network.

“They know if you are an MTN customer, you will call MTN so he will move it to Telecel or AT. By the time MTN takes any action, they would have cashed out,” he explained.

Ing. Dr. Ken Ashigbey however indicated that the Telecommunication Companies and the Digital Payment Platforms are discussing ways of quickly triggering a system that freezes and blacklists all transactions on any mobile number which has been flagged for suspected fraud.

GhIPSS Operations

The engine house behind Mobile Money Interoperability, the Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) would not take the flack for the fraudulent activities of cyber fraudsters and scammers insisting it deals solely with banks, FinTech companies and Mobile Network Operators offering digital financial transactions and not with end-users.

GhIPSS however blames the settlement holdups on both operational and technical challenges.

Explaining the processes behind the MMI Infrastructure, Manager, Real Time Payments, Richard Akuoko Sarpong pointed out that a system hitch could come from multiple sources.

“The banks have their infrastructure, the Telcos have their infrastructure; GHIPSS has our infrastructure and they all integrate to serve all of us.”

You could be sending money and the system of the receiving institution is down. It could be from a network issue; from an application issue or anything else. So who do you blame,” he asked.

Richard assured that the players on the interoperability platform have signed off a Service Level Agreement (SLA) that mandates each player to keep a certain standard to ensure efficiency across the board,

He is optimistic the safeguards should smoothen out the bottlenecks with minimal reverse time and fewer hitches when each player continues to meet, improve and exceed the standard requirements of the SLA.

SIIPS Interoperability

The third annual State of Inclusive Instant Payment Systems (SIIPS) in Africa report offers an authoritative and insightful assessment of the exciting progress countries are making to expand digital payment access to all Africans.

According to the report launched by the Africanenda FOUNDATION, “Inclusive instant digital payment systems are more than just a financial tool but a cornerstone of digital public infrastructure (DPI).

It emphasizes that Countries that build a safe and inclusive DPI—with interoperable core components such as digital payments, ID, data exchange, and consent—will create vibrant and competitive economies with enhanced chances of achieving the United Nations Sustainable Development Goals.

Along the four graduated inclusivity indicators of unranked, basic, progressive and matured; Ghana’s Interoperability Payment systems is ranked progressive aiming towards maturity.

Deputy CEO of Africanenda Sabine Mensa is positive Instant Payment Systems in Africa including that of Ghana, should sail towards mature inclusivity when it inculcates customer recourse mechanisms that prioritize the needs of the customers and swiftly responds to the customer’s complaints.

If the sector players can compete to ensure that the services are available to the consumer, accessible to the consumer and relevant to the consumer at a price they can afford and when adoption is incentivized; it will accelerate the process,” Sabine proposed while addressing a news conference in Accra.

If Sabine’s advice were taken, Jenifer might not have had to wait two weeks for no fault of hers, to have her held up cash reversed.

Sarah Brefo, Emmanuel Anyan, Nancy and Attah Yeboah would also have more options and flexibility while enjoying the enablers, benefits and wide range of possibilities the MMI system brings to Ghana.

This report is produced under the Digital Public Infrastructure (DPI) Africa Journalism Fellowship Program of the Media Foundation for West Africa and Co Develop.